Happening Now

Passengers Should Weigh In on Union Pacific Merger

August 1, 2025

By Jim Mathews / President & CEO

Union Pacific shook up the rail world on Tuesday when it confirmed that it expects to acquire Norfolk Southern in a friendly deal that would see N-S become a wholly owned subsidiary of UP, creating a truly trans-continental railroad for the first time in U.S. history. But what does it mean for Amtrak, for passenger-rail services generally, and for all of us whose trains will use the new combined railroad’s right-of-way to get us where we need to go?

If you read social-media comments, you’d conclude that we already have all the answers to those questions. Certainly, the social media commentariat does!

But the reality is, we don’t really know yet. The two railroads have to go before the Surface Transportation Board – rail’s Federal economic regulator – to get the deal approved. UP doesn’t expect to put the formal application before the Board until at least three months from now and probably, more likely, sometime in January next year. And that formal application will be the first time all of us who care about what happens will get to see the details on what Union Pacific and Norfolk Southern executives have in mind.

Those details, including any plans for concessions related to passenger-rail concerns, will be critical to deciding what our position ought to be. In addition, there will probably be an evidentiary process and hearings, and we’ll learn more during those events, too.

So far, I’m standing by what I told many of the reporters who contacted me on Tuesday – America’s passengers and shippers have good reason to treat this news with skepticism, and for our part we’ll be actively involved in protecting the rights of passengers as STB examines this proposal. The past decade has seen Class I railroads steadily losing market share to trucking in pursuit of shareholder dividends. While that’s been good for Wall Street, it’s meant worse rail service for passengers and shippers in the rest of the country. That means we’ll keep an eye on the filings to the docket and take every opportunity as a non-party to ensure that passengers’ concerns are addressed, whether that’s filing formal responses or testifying at any public hearing the Board might convene.

Meanwhile, UP is already clearing the decks ahead of seeking approval for the transaction. I noted in our formal press statement this week that this merger would combine two railroads each under investigation for violating Amtrak’s legal right in 49 U.S.C. § 24308(c) to preferential dispatching – Union Pacific in a proceeding before the STB, and Norfolk Southern in a D.C. Federal district court before Judge Amy Berman Jackson following a Dept. of Justice civil complaint filed during the final year of the Biden Administration. Norfolk Southern has been working offline with the Trump Administration’s DOJ to settle their case, and yesterday Amtrak asked the STB to drop the UP late-trains case because it had reached a settlement with Union Pacific.

The real-world effect of these two settlements will be to free the STB to use its limited resources to fully consider how U.S. rail transportation might be changed by UP swallowing N-S, without the baggage of those two preference clause cases sitting there unresolved. It’s a shame we didn’t get a precedent-setting ruling on what “preference” means from either of those two venues, but that’s a fight for another time.

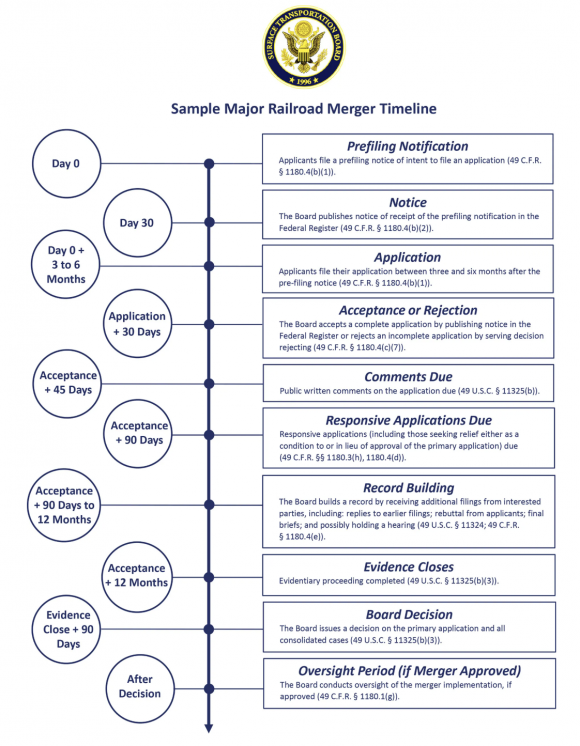

The Board’s communications team has done a real public service this week in creating a separate landing page on its website for information on mergers and how the STB is involved in considering them. It’s very much worth your while to go look over those materials. Of particular note is this visual timeline of how merger transactions, generally, go through the STB process...a process Federal law explicitly grants STB the authority to execute.

Here are the takeaways I hope you get from looking over the timeline: one, announcement of a merger is not the same as completing a merger; two, the STB will consider the totality of the effects on the national transportation system as it examines the transaction, including “the effect of the proposed transaction on the adequacy of transportation to the public” (required under Federal law, 49 U.S.C. § 11324(b)), and; three, there are several opportunities for the public to weigh in on this proposal. All of us should take advantage of those opportunities when they come up.

Overall, for the moment, I remain skeptical. There are certainly rare examples in history when monopolies were actually a good thing – AT&T comes to mind, with cheap, reliable phone service thanks to Western Electric. But generally, competition makes things better for consumers and buyers, and we’ve seen rail mergers too often make things worse for shippers and supply chains, and by extension for passengers, as well.

The transparency of the independent STB process will be a great way for passenger-rail advocates to use the safeguards our American system has given us to use our voices. Moreover, I know with certainty that all four of the currently sitting members of the STB are careful, thoughtful, professional people, supported by a genuinely talented – if small and overworked! – staff of analysts, economists, and experts recruited from industry.

Once the formal application is filed to the docket, your Association intends to look very closely at the proposal to see how the two railroads plan to address passenger concerns, whether and how the assurances UP gave to Amtrak to settle the Sunset Limited case will flow through to the newly created entity, and whether the application meets the statutory requirement for completeness. We’ll be looking to hear from our members on these issues as well.

As many of you know, I’m also a voting member on the STB’s Passenger Rail Advisory Committee. It’s important for everyone reading this to understand that the PRAC can’t get involved in any active matter pending before the Board. So that means our PRAC meetings and subcommittee meetings won’t be appropriate venues for us to weigh in on the merger. But to the extent that we can talk generally about issues that are not specific to the merger proposal – but which might come up as part of the proposal – I certainly expect to take that opportunity during PRAC meetings.

So let’s all get ready for a long ride...

"It is an honor to be recognized by the Rail Passengers Association for my efforts to strengthen and expand America’s passenger rail. Golden spikes were once used by railroads to mark the completion of important rail projects, so I am truly grateful to receive the Golden Spike Award as a way to mark the end of a career that I’ve spent fighting to invest in our country’s rail system. As Chair of the Transportation and Infrastructure Committee, it has been my priority to bolster funding for Amtrak, increase and expand routes, look to the future by supporting high-speed projects, and improve safety, culminating in $66 billion in new funding in the Bipartisan infrastructure Law."

Representative Peter DeFazio (OR-04)

March 30, 2022, on receiving the Association's Golden Spike Award for his years of dedication and commitment to passenger rail.

Comments